Taxes must be set up in Accounting Settings and then configured on individual Bill Codes so they can be calculated on invoices.

Note that you must have already set up at least one GL Liability Account to be able to create Taxes.

![]() Roles and Permissions: you must have the Accounting>Edit Accounting Settings ACL to be able to view the Accounting Settings tab.

Roles and Permissions: you must have the Accounting>Edit Accounting Settings ACL to be able to view the Accounting Settings tab.

Set Up a Tax

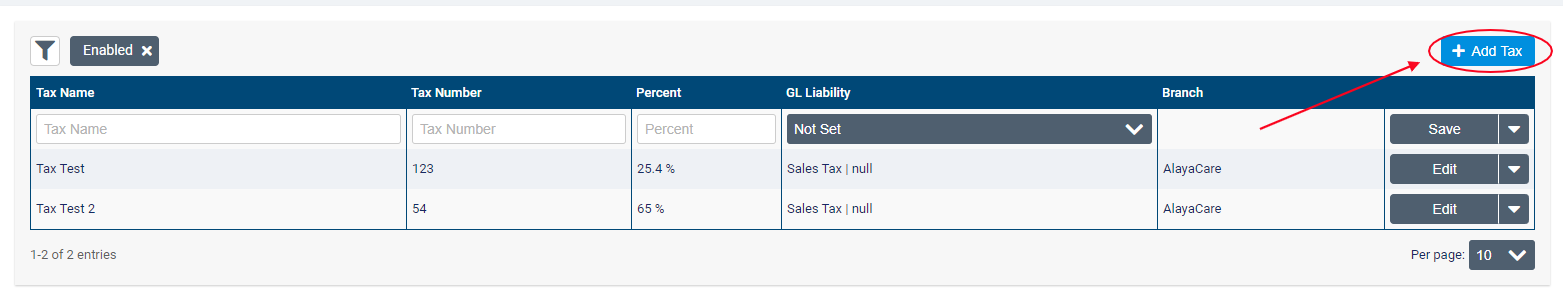

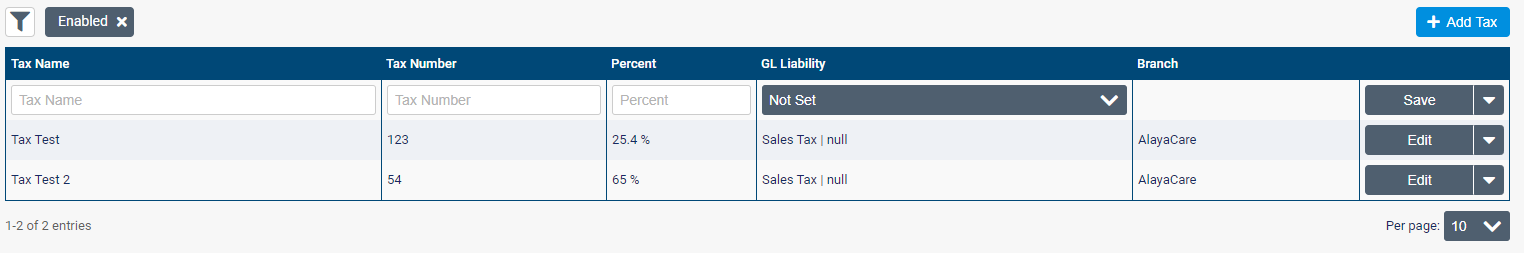

Navigate to the Taxes list in Accounting>Accounting Settings>Taxes.

By default the Taxes list will be filtered to Enabled Taxes. Click the ![]() icon to change the Status filter to All or Disabled. You can use the Search bar to search by Tax Name or Number.

icon to change the Status filter to All or Disabled. You can use the Search bar to search by Tax Name or Number.

To create a new Tax, click +Add Tax.

Enter the Tax Name, Tax Number, and Percent. select the GL Liability Account, and click Save.

Edit or Disable a Tax

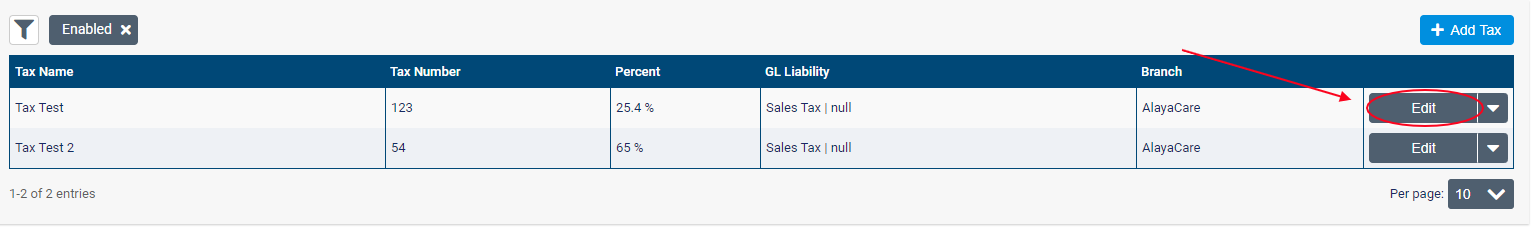

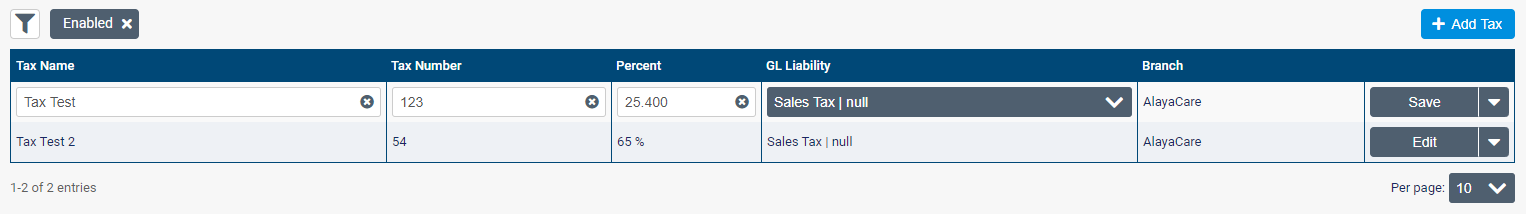

Select the Edit button to make changes to the Tax.

You can adjust the Tax Name, Number, Percent, or GL Liability Account. Click Save to save your changes.

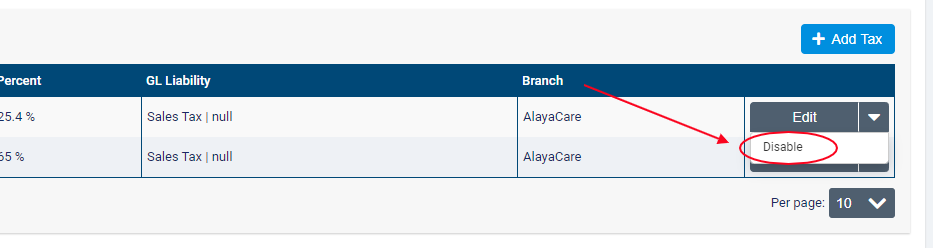

To disable a Tax, click the downward arrow next to Edit and select Disable.

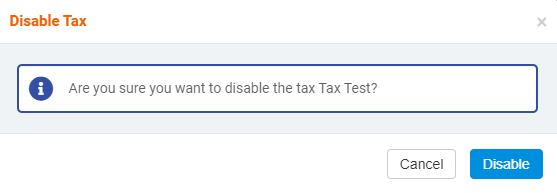

In the dialogue box, click Disable to confirm.

Comments

0 comments

Article is closed for comments.