When Invoices are issued for one or more Visits, Sale Transactions are logged in the Subledger once the Invoice is marked as Sent. If payment is no longer expected for a sale, the cost of a Visit or Invoice can be written off in the Subledger by using the Writeoff Transaction Type.

You can enter a Writeoff transaction from an Invoice or from a Client's Balance and Transactions page.

Enter a Writeoff from an Invoice

You can add a Writeoff-type transaction directly from the Invoice you wish to write off. You can choose to write off the entire amount or only the cost of select Visits.

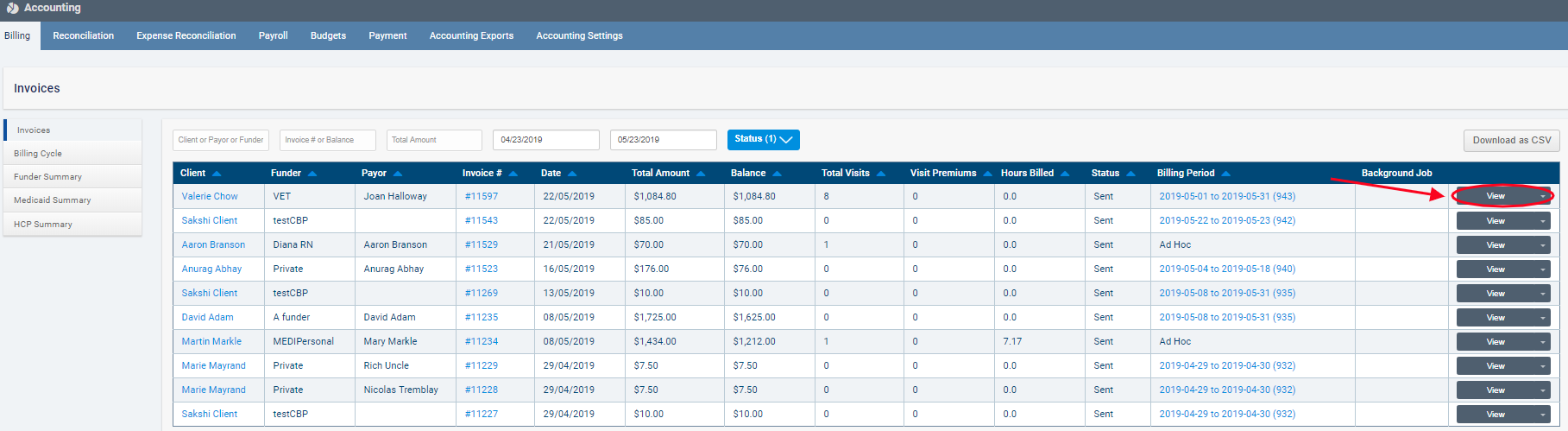

To begin, go to Accounting>Billing>Invoices and click View on the Invoice you wish to write off.

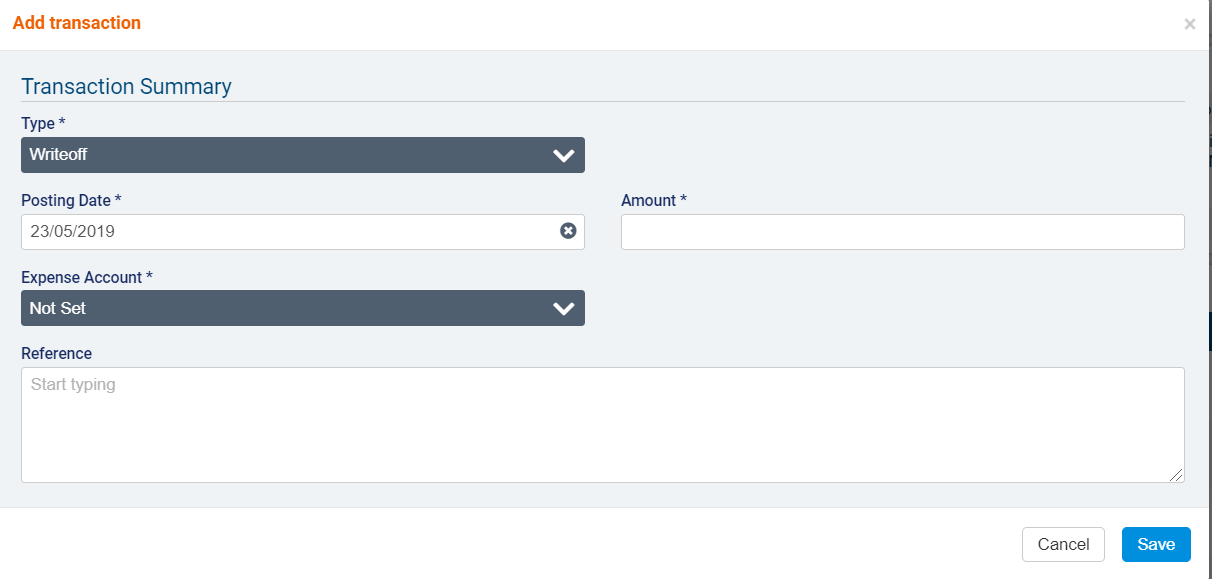

Click Add Transaction.

Select Writeoff as the Transaction Type. The Posting Date will default to today's date but can be adjusted as necessary.

Enter the Amount you wish to write off from the Invoice. If you would like to write off the entire Invoice, enter the total Balance listed on the Invoice. If you only wish to write off the cost of certain Visits or Premiums, enter the total cost (including taxes) of all items being written off.

Select the Expense Account that will be debited in the transaction. The dropdown will contain a list of all GL Expense Accounts configured by your agency in Accounting>Accounting Settings>Accounts.

If you wish to add a memo about the Writeoff, use the Reference field.

When you have entered the necessary information, click Save to complete the transaction.

If the entire amount of the Invoice has been written off, the status of the Invoice will change to Written Off.

If only part of the invoice total has been written off, the Balance will be updated accordingly and the status will remain Sent.

Enter a Writeoff from a Client's Balance and Transactions

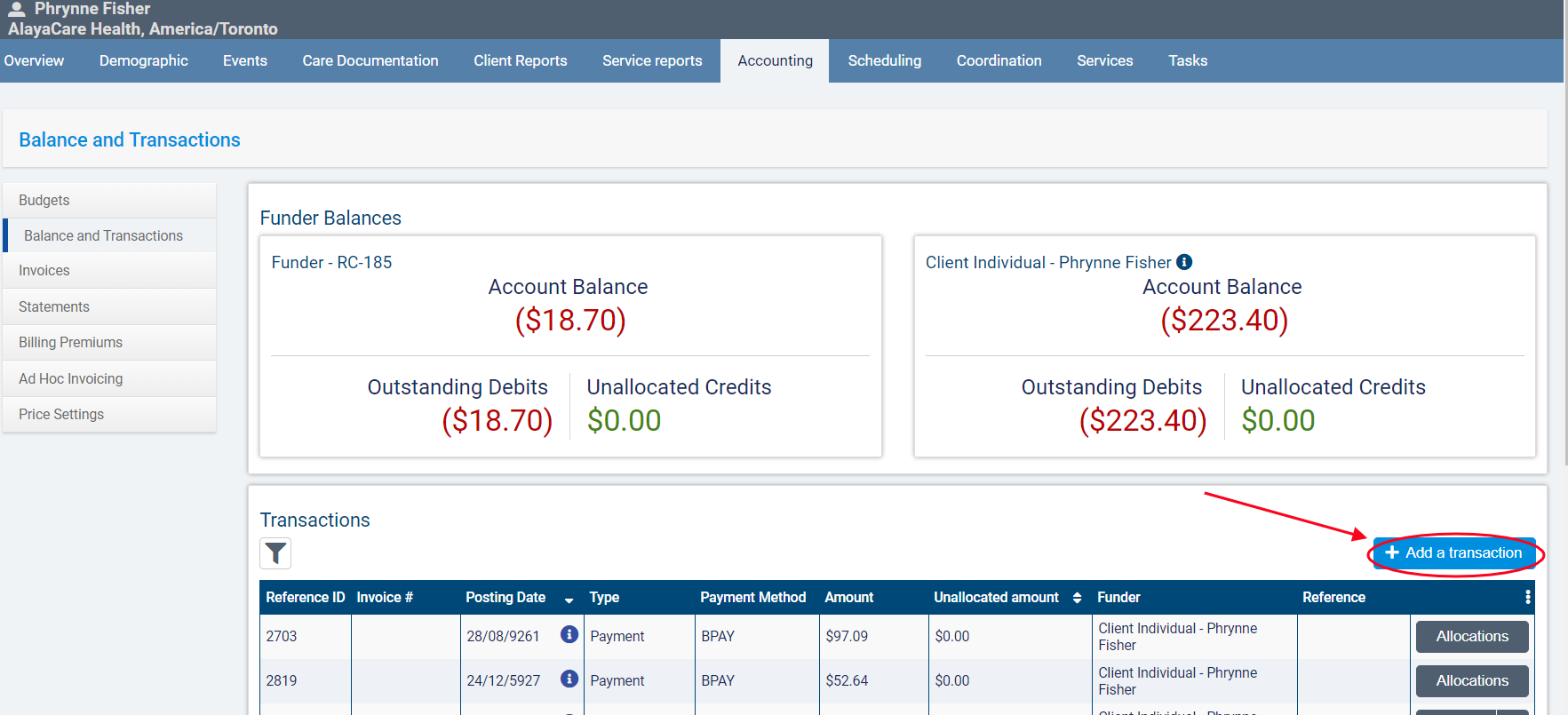

To write off part of a specific Client's Balance, go to the Client's profile and click Accounting>Balance and Transactions. From here, click Add a transaction.

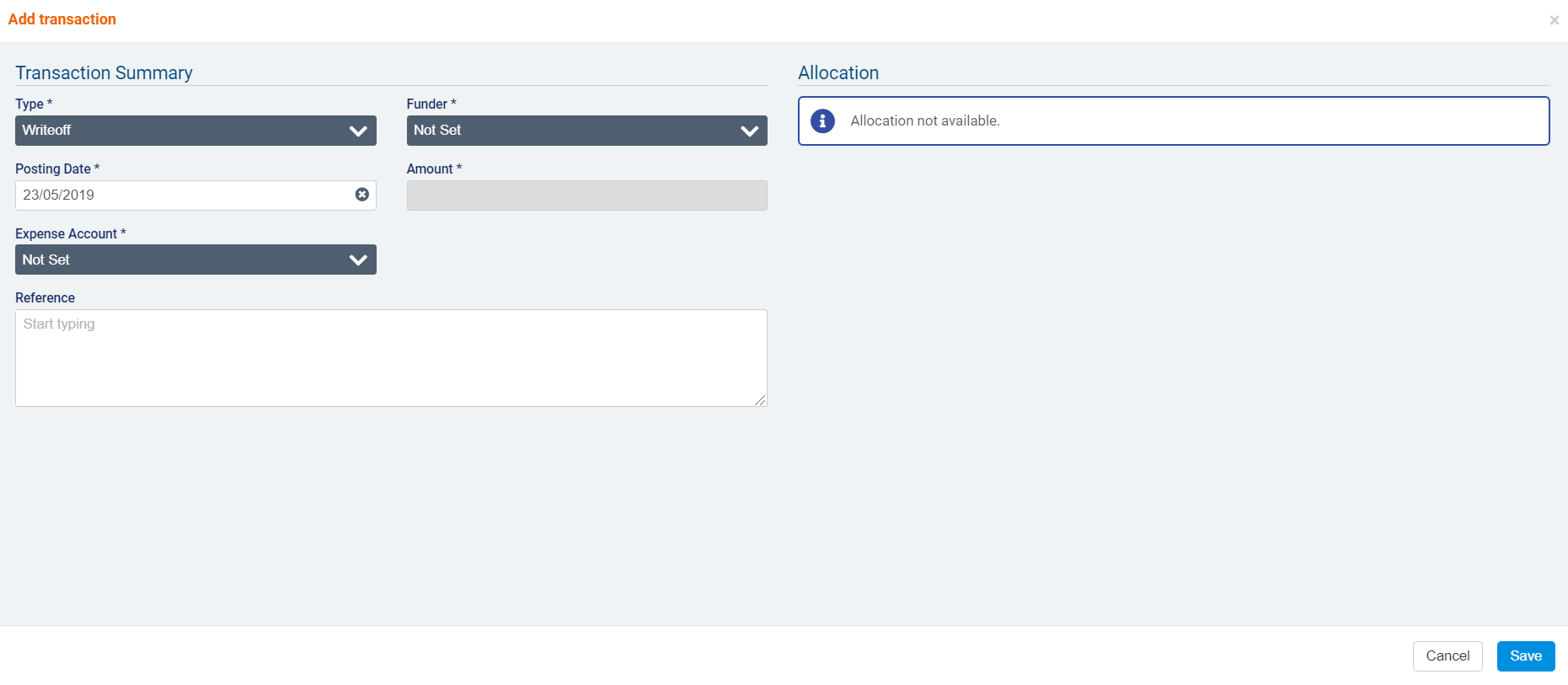

In the resulting dialogue, select Writeoff as the Transaction Type and select the Funder associated with the Invoice or Visit(s) you wish to write off.

The Posting Date will default to today's date but can be adjusted as necessary.

Select the Expense Account that will be debited in the transaction. The dropdown will contain a list of all GL Expense Accounts configured by your agency in Accounting>Accounting Settings>Accounts.

Use the Reference field if you wish to enter a Memo for the Writeoff.

When you have entered all of the relevant information, click Save to complete the transaction. The Client's Balance will be updated accordingly.

View Writeoff Transactions in the Subledger

All Writeoff Transactions are recorded in the Subledger.

For each Writeoff Transaction, there are two entries in the Subledger: a credit and a debit. The account credited is the GL Receivables set on the Funder. The account debited is the GL Expense Account selected when entering the transaction details (as shown above).

The Posting Date of the transaction is the date entered as the Posting Date when creating the transaction. The Transaction Date is the date the transaction was performed in the system.

For example, if on May 15, you are logging some final transactions to close your books for April and enter a Posting Date of April 30:

- The Posting Date will be 4/30/2019.

- The Transaction Date will be 05/15/2019.

To export your Subledger, go to to Accounting Exports, click Add Accounting Export, and select the desired Subledger Type.

Comments

0 comments

Article is closed for comments.