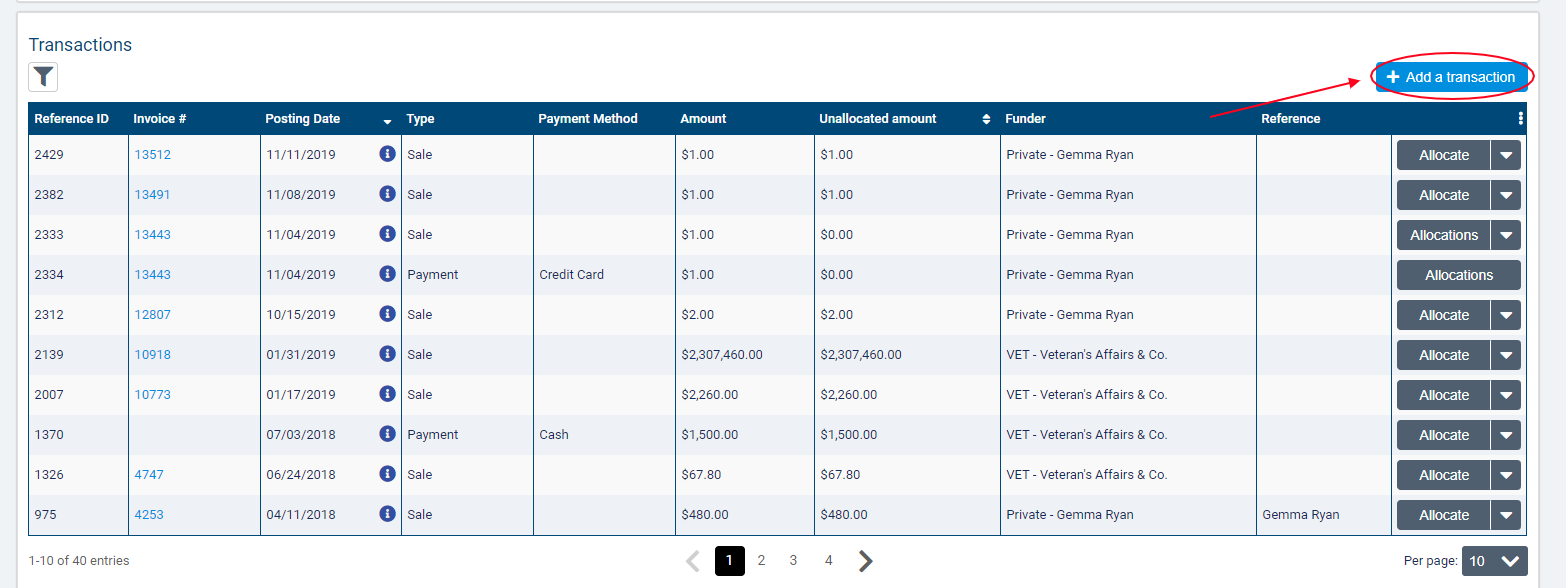

The Balance and Transactions page on a Client's profile contains balance cards with the the total Account Balance, Outstanding Debits, and Unallocated Credits for every Funder listed on one of a Client's Services. The total list of transactions for the Client will be listed below the balance cards.

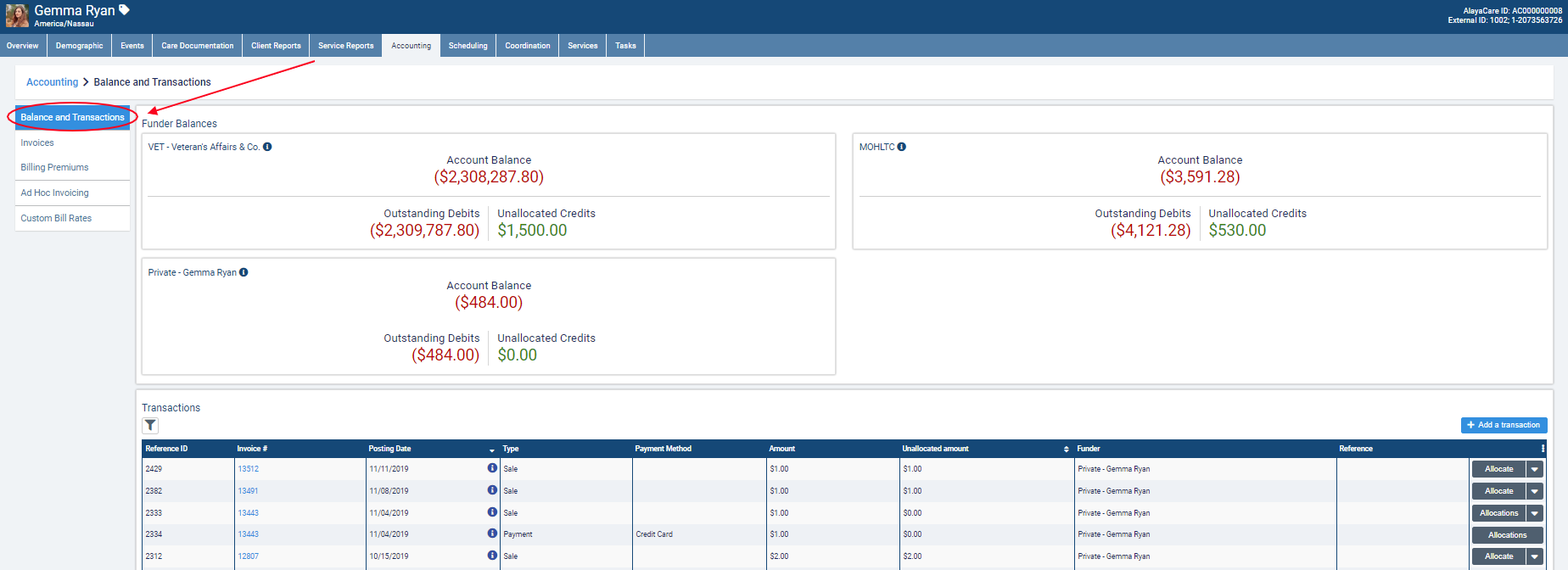

To access Balance and Transactions, go to Accounting>Balance and Transactions on the Client profile.

Review Funder Balances and Transactions

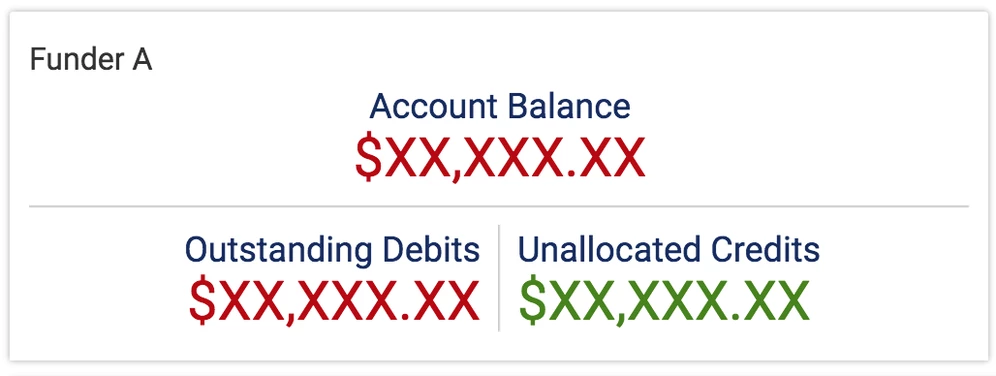

In Balance and Transactions, a balance card will exist for every Funder that has funded at least one of the Client's Services.

Outstanding Debits represent any unpaid debits to the Funder's Accounts Receivable for the Client. These debits will generally be Invoices but will include any AR debits made by the user.

Unallocated Credits represent any credits in the Funder's Accounts Receivable for the Client that have not yet been applied. These will generally be Payments and Credit Notes but will include any AR credits made by the user.

The Account Balance for the Funder equals Outstanding Debits minus Unallocated Credits.

The Account Balance will be zero if the amount on unpaid Invoices for the Funder and Client equals the amount of unallocated Payments. Since all three totals are visible, however, you will be able to see if any action is required to apply a payment to an Invoice.

If the balance is greater than zero (red), then the user has outstanding unpaid debits and not enough credits remaining to settle them. If the balance is less than 0 (green), then the user has more outstanding unapplied credits than debits to pay.

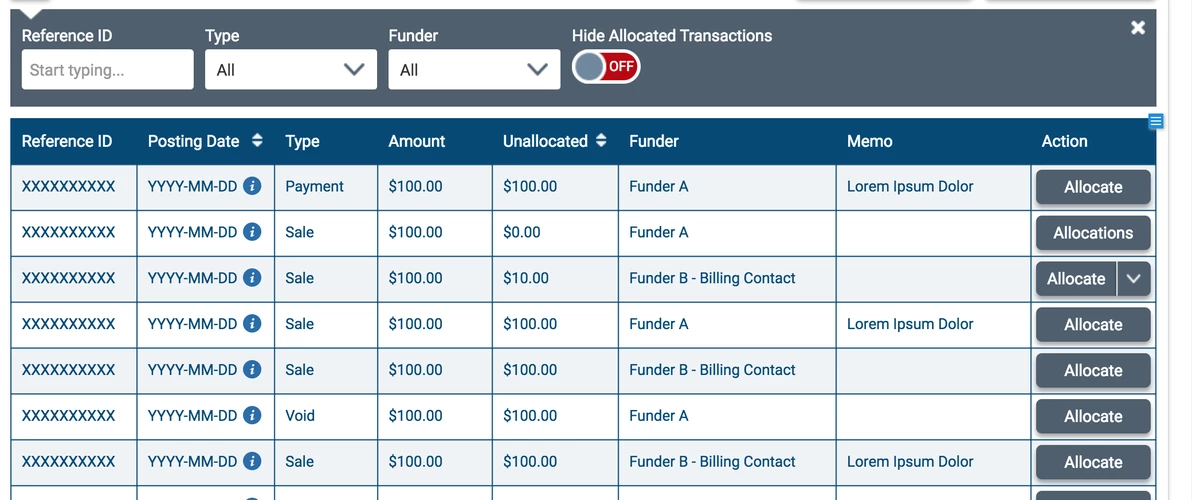

The total list of the Client's transactions will appear below the balance cards.

They can be filtered by Type and Funder and searched by Reference ID or Invoice Number. The toggle Hide Allocated Transactions allows you to filter out all transactions that have no remaining balance.

Every transaction created for the specific Client will appear in the transaction list. Every time an Invoice is marked as Sent, a Sale Transaction will appear in the transaction list.

For each transaction, the Posting Date (selected upon creation) is displayed. You can hover over ![]() to view the actual date the transaction was created (Transaction Date) as well as the user who created it.

to view the actual date the transaction was created (Transaction Date) as well as the user who created it.

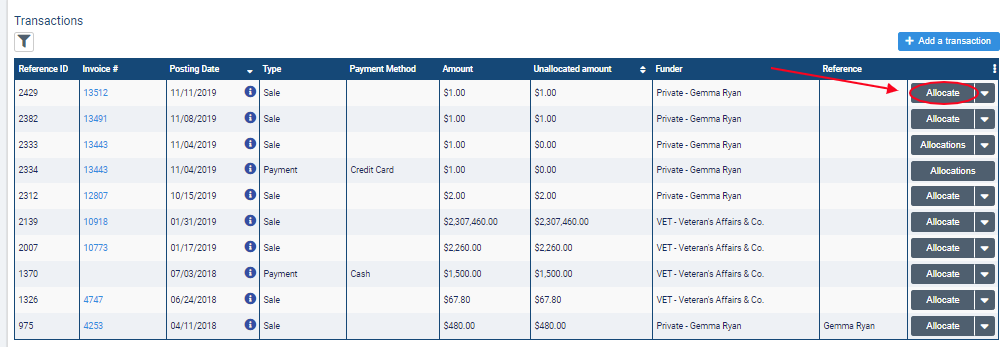

The Unallocated amount column represents the remaining balance of the transaction. If the Unallocated amount is more than zero, you will have the option to Allocate the amount.

Add Transactions and Allocate Payments

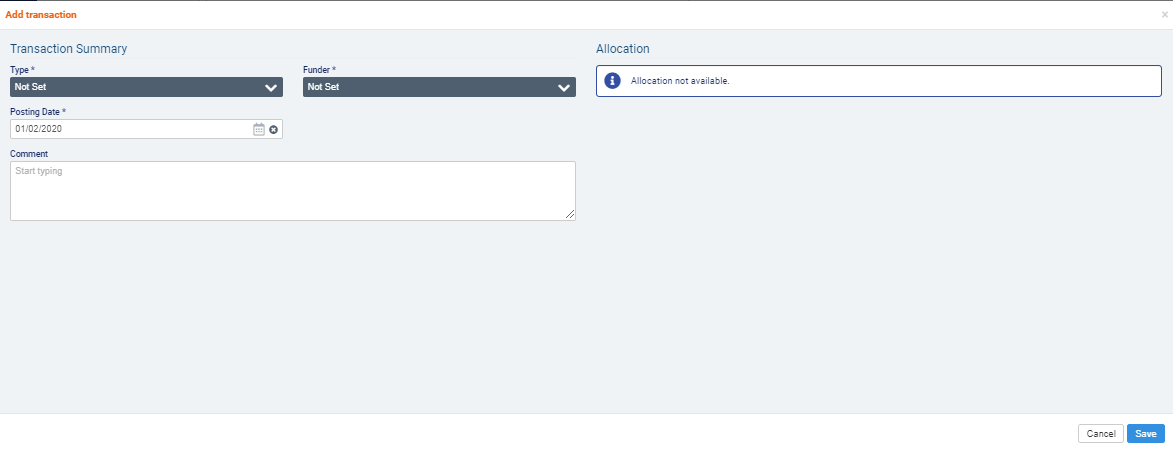

To create a new transaction for the Client, click +Add a transaction.

Once you select the Transaction Type, other fields specific to the type may appear. All mandatory fields are marked by an asterisk.

Depending on the transaction, you may be able to allocate the transaction immediately upon creation. A transaction which is an AR Credit can be allocated only to a transaction which is an AR Debit.

Any transaction created in a client's Balances and Transactions tab is created for a specific Funder and can only be allocated to a transaction by the same Funder.

The following Allocation options are available:

- No allocation: no allocation will be made.

- Allocate automatically - oldest transactions first: the transaction will be allocated automatically according to the Posting Dates of the transactions it is being allocated to. For example: Allocate automatically is selected when logging a payment of $500, and the Client has three outstanding Invoices for the same Funder (Invoice 1 - Oct 1: $300, Invoice 2 - Oct 2: $300, and Invoice 3 - Oct 3: $300). In this scenario, $300 of the payment will be allocated to Invoice 1, and $200 to Invoice 2.

- Manual allocation: you decide how the transaction is allocated. For example: Manual allocation is selected when logging a payment of $500, and the Client has three outstanding Invoices for the same Funder (Invoice 1 - Oct 1: $300, Invoice 2 - Oct 2: $300, and Invoice 3 - Oct 3: $300). In this scenario, you may decide to allocate $300 toward Invoice 1 and $200 to Invoice 3 because Invoice 2 is in dispute.

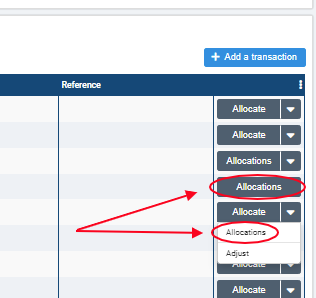

If you decide not to allocate the transaction immediately, you can return to it later by selecting the Allocate button from the transactions list for any transaction with a remaining unallocated balance.

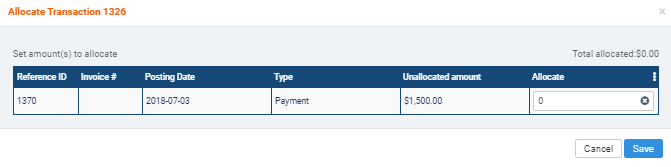

In the resulting dialogue, enter the amount you wish to allocate toward each available transaction in the Allocate field.

The Total allocated at the top right of the table tracks the total of allocations entered in different rows.

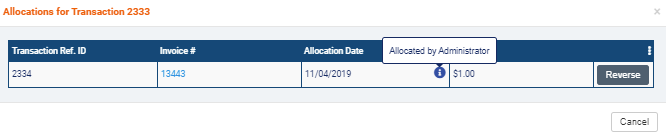

You can also select Allocations for a transaction to view a list of all allocations that have been made. This option will be available as either a button or a dropdown option when you click the arrow next to Allocate.

In the Transaction Allocations dialogue, you will be able to view which user created the allocation by hovering over ![]() in the Allocation Date field.

in the Allocation Date field.

You will also have the option to Reverse an Allocation except in the following situations:

- The Allocation is a Void. Voids cannot be reversed.

- The Allocation was made beyond the Reverse Allocation Limit (see below).

- You do not have the correct permissions (ACL Manage transactions).

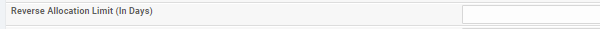

The Reverse Allocation Limit is based on what is entered in the Reverse Allocation Limit (in Days) field in Settings>All Settings>System Settings>Accounting. If this setting is set at a number x, allocations can be reversed up to x days after they have been made. If this setting is left blank, there is no limit to how many days in the past an Allocation can be reversed. If this setting is set at 0, an Allocation can never be reversed (with the exception of Cancel Cash Receipts; see below in Transaction Types.)

Transaction Types

Sale

A Sale is created when an invoice is marked as Sent. An invoice in draft does not yet have a corresponding Sale Transaction.

Subledger:

- AR DR: total of the Invoice, including taxes. The AR is set on the Funder.

- Revenue 1 CR: total of revenue for Revenue 1. The Revenue account is set on a Bill Code.

- Revenue n CR: total of revenue for Revenue n. The Revenue account is set on a Bill Code.

- Liability 1 CR: total of taxes for Liability 1. The Liability account is set on tax 1.

- Liability n CR: total of taxes for Liability n. The Liability account is set on tax n.

Void

When creating a Void Transaction, you will have to select the Invoice it will be allocated to upon creation.

Only Invoices which have not received any Allocations can be voided.

The Allocation of a Void cannot be reversed.

Subledger (exact reversal of the selected Sale):

- AR CR: total of the Invoice, including taxes. The AR is set on the Funder.

- Revenue 1 DR: total of revenue for Revenue 1. The Revenue account is set on a bill code.

- Revenue n DR: total of revenue for Revenue n. The Revenue account is set on a bill code.

- Liability 1 DR: total of taxes for Liability 1. The Liability account is set on tax 1.

- Liability n DR: total of taxes for Liability n. The Liability account is set on tax n.

Payment

When creating a Payment, you are required to select a Payment Method.

Subledger:

- AR CR: total of Payment. The AR is set on the Funder.

- Bank DR: total of Payment. The Bank is set on the Funder.

Cancel Cash Receipt

When creating a Cancel Cash Receipt Transaction, you must select which Payment to allocate to upon creation.

If the selected Payment had any previous Allocations, they will be reversed. This will happen even if the Allocations were made beyond the Reverse Allocation Limit.

Subledger:

- AR DR: total of Payment. The AR is set on the Funder.

- Bank CR: total of Payment. The Bank is set on the Funder.

Writeoff

When creating a Writeoff Transaction, you must select an Expense Account.

Subledger:

- AR CR: total of Writeoff. The AR is set on the Funder.

- Expense DR: total of Writeoff. The Expense Account is selected by the user.

Credit Note/Debit Note

When creating a Credit Note or Debit Note, you will have to select which invoice items are being credited/debited so the proper Revenue Account(s) will be applied.

When an invoice item is selected for a Credit Note, its balance is reduced.

When an invoice item is selected for a Debit Note, its balance is increased.

An invoice item's balance can never be lowered below 0.

For example: An invoice item x on Invoice 123 has a value of $20. A Credit Note can be created for up to $20 for this invoice item. If a Debit Note of $5 is created for invoice item x, invoice item x now has a value of $25. A Credit Note could now be created for invoice item x of $25.

Subledger (CREDIT NOTE):

- AR CR: total of the Credit Note, including taxes. The AR is set on the Funder.

- Revenue 1 DR: total of revenue for Revenue 1. The Revenue Account is set on a Bill Code.

- Revenue n DR: total of revenue for Revenue n. The Revenue Account is set on a Bill Code.

- Liability 1 DR: total of taxes for Liability 1. The Liability Account is set on tax 1.

- Liability n DR: total of taxes for Liability n. The Liability Account is set on tax n.

Subledger (DEBIT NOTE):

- AR DR: total of the Debit Note, including taxes. The AR is set on the Funder.

- Revenue 1 CR: total of revenue for Revenue 1. The Revenue Account is set on a Bill Code.

- Revenue n CR: total of revenue for Revenue n. The Revenue Account is set on a Bill Code.

- Liability 1 CR: total of taxes for Liability 1. The Liability Account is set on tax 1.

- Liability n CR: total of taxes for Liability n. The Liability Account is set on tax n.

Comments

0 comments

Article is closed for comments.