The Invoice & Payroll - Adjustments feature can be used to keep track of changes made after a Visit has been processed in Payroll. Any changes that could affect the pay for that Visit will be tracked, and Adjustments (either positive or negative) will be carried over into the future period, according to the Carry-Over & Adjustment Date that was set for the Payroll Period.

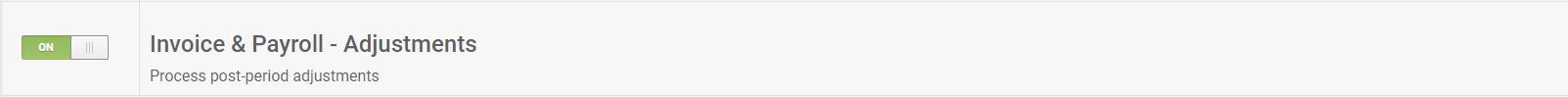

To use this feature, your agency must have the Invoice & Payroll - Adjustments feature flag enabled in Settings>Features and its required users must be configured with the Closed Visit Payroll Adjustments ACL.

In-Period Adjustments vs. Closed Period Adjustments

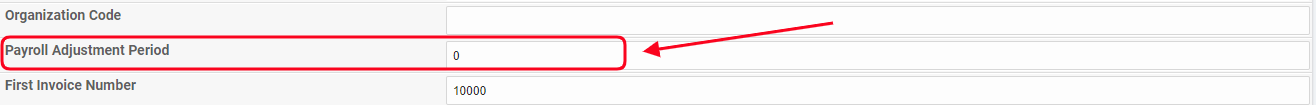

In-Period Adjustments are based on the number of days allowed for Adjustments set as the Payroll Adjustment Period in System Settings>Accounting. If configured, this setting allows you to re-run payroll to account for Adjustments made within the number of days set as the Adjustment Period after the date that the period was closed. This only applies for Adjustments made to the original period.

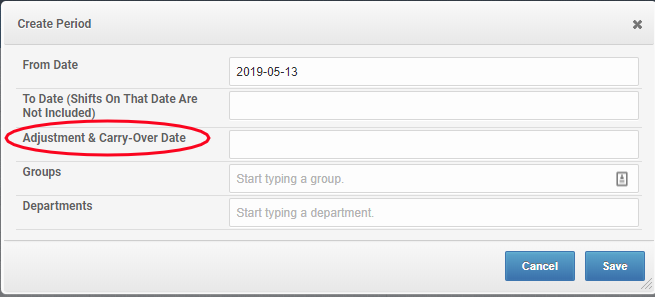

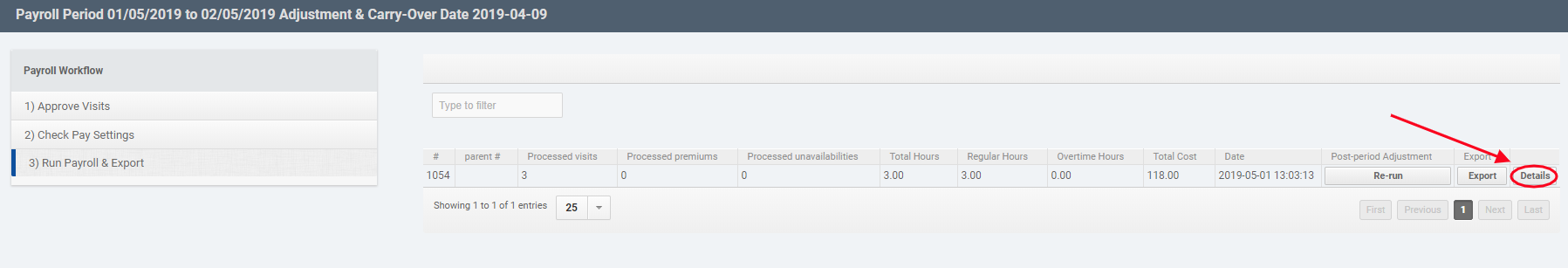

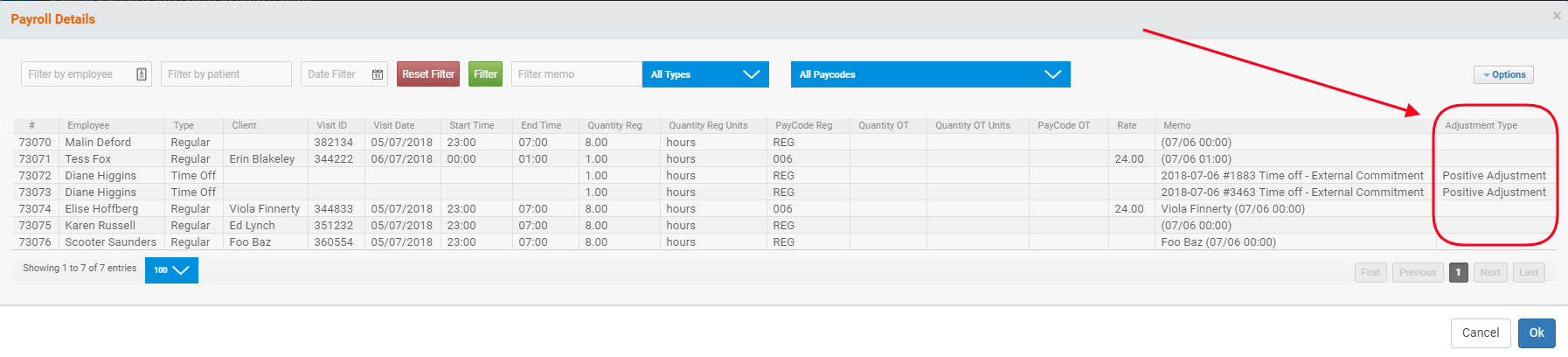

Adjustments that are carried over into future periods are handled through Closed Period Adjustments. When the Invoice & Payroll - Adjustments feature flag is turned on, the system will track changes made to Visits and Premiums in a Closed Payroll Period that could affect pay for the Visits. These Visits can then be included in a new Payroll Period by setting a Carry-Over & Adjustment Date in the past that will include the dates of the edited Visits/Premiums.

The following types of changes are captured as Adjustments during post-period processing:

- Change in approved duration

- Change in Visit Start Date or Time

- change in Visit End Date or Time

- Changes to a Premium

- Change in quantity of units (Visits or Hours)

- Change in Premium Code

- Change in Premium apply date

- Change in Service Code

- Change in Pay Code

- Change in Cancelled Code

Carry-Overs include the following types of changes:

- Late Visit entry or late approval

- Late entry of a Premium

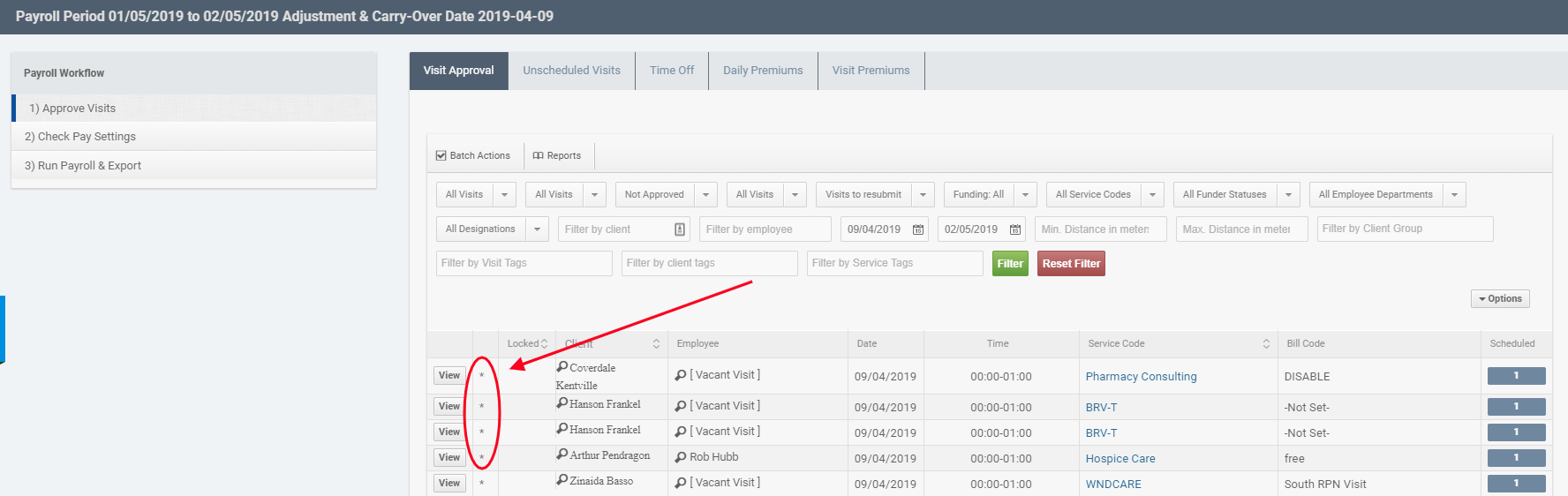

Note: once Payroll has been run, the Visits in this period will be locked for editing. You must be configured with the Edit Locked Visits ACL to make changes.

Payroll Adjustment Setup

To include Closed Period Adjustments in a new Payroll Period, you must set the Adjustment & Carry-Over Date for the period back to a date that can include the edited Visits. Visits from that date to the Start Date will be included if they have been modified or added since the last Payroll Period.

Related to

Comments

0 comments

Article is closed for comments.